Contents

- Real Account:

- Better financial decisions

- Advantages of Double-Entry System of Bookkeeping

- India Dictionary

Definition, Features and Examples

If a business has a sound budget based on proper accounting practices, it can act as a strong foundation for growth. When a firm properly calculates its financial statements, it assists in proper business valuation. Furthermore, it helps in getting more investments and thereby expanding the business.

You debit the decrease and credit the increase for a capital account. For the revenue account, you debit the decrease and credit the increase. For the drawings account, you debit the increase and you credit the decrease.

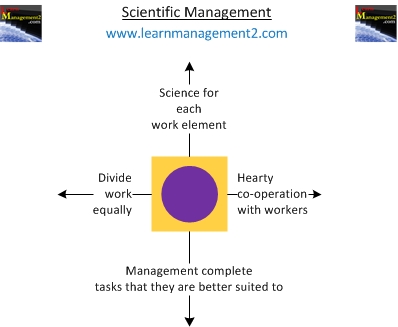

Real Account:

Each of the laws is straightforward to comprehend on its own. To comprehend these norms, we must examine them individually and in context. Let’s look at the purpose of accounting in a firm, who it affects, and the advantages of strong accounting procedures that adhere to these three golden accounting laws. Luca Pacioli, the founder of accounting, was the first to mention Double-Entry bookkeeping, which is being used today. In the nineteenth century, Scotland gave birth to the modern profession of chartered accountancy. When the number of expected inflow number flows is unpredictable, the organization must identify the lowest possible revenue and the most significant potential expenses using this approach.

Income or gains accounts record the earnings of the business. Income accounts are further classified into Gains and revenue accounts. This account represents the inflow of cash into the business. Other examples include income from interest and services revenue. For example, accounts regarding land, building, investment, fixed deposits, etc., are real accounts. As you know that in T-accounts increase and decrease entries are made on the left and right side of the accounts for assets respectively and vice-versa for liabilities.

As a result, it’s a good idea to stick to the recommended approach of keeping accounting books and keeping track of all income and expenses. Debit all expenses and losses, and credit all incomes and gains. As real accounts are carried forward to the next fiscal year, they are not closed at the end.

Conversely, accounting has rules in place to address the scenario. If the transactions are of international nature, for every missing transaction, 2% of the value of each will be applicable. Therefore, it is prudent golden rules of double entry accounting system to follow the prescribed method of maintaining accounting books keeping track of all income and expenses. Accounting has been around since time immemorial and can be traced back to Mesopotamian civilizations.

Better financial decisions

Since economic entities are compared to understand their financial status, there has to be uniformity in accounting. In other phrases, we are able to say that if we add a financial institution column to both sides of a single column money book, it will become a double column money e-book. The three different types of accounts in accounting are Real, Personal and Nominal Account. Real accounts are those accounts which are related to assets or properties or possessions.

- Each of the laws is straightforward to comprehend on its own.

- Representative-Representative personal accounts are not in the name of any person or organization but are represented as personal accounts.

- Hence, in the journal entry, the Employee’s Salary account will be debited and the Cash / Bank account will be credited.

- Budgeting and Future Projections – A healthy budget based on proper accounting processes may provide a solid foundation for any organization to grow.

- Allow for the systematic documenting of financial transactions.

Irrespective of the strategy used, the impact on the books of accounts remains the identical, with two elements in each of the transactions. We now provide eight Certificates of Achievement for Introductory Accounting and Bookkeeping. Likewise,credit score buy journal could have a debit column for purchases , a debit column for GST paid, and a credit column for accounts payable. Examples of real accounts include equity, asset, and liability accounts. When the business is acquiring something such as an asset, then the account of the business has to be debited.

Advantages of Double-Entry System of Bookkeeping

Debit what comes in, credit what goes out, states Golden Rule 2. If a firm obtains something of value , it is debited in the books in a real account. When something valuable leaves the company, it is recorded as credited in the books. So, get to know the three accounting golden rules that https://1investing.in/ simplify the complicated task of recording financial transactions. The ledger accounts which contain transactions related to the assets or liabilities of the business are called Real accounts. Accounts of both tangible and intangible nature fall under this category of accounts, i.e.

Rent is considered as an expense and thus falls under the nominal account. So, according to the golden rules, you have to credit what goes out and debit all losses and expenses. The double-entry accounting method is utilized by most companies throughout the world. However, some businesses that have strictly cash transactions might use the one entry bookkeeping methodology as a substitute.

India Dictionary

Once a transaction has been done, it shows how that transaction should be recorded in the books. Maintaining financial transaction accounts according to accounting’s golden standards has several benefits. This assumption suggests that the company will continue as usual until the conclusion of the next accounting period and that there is no contradictory information. Since the going concern principle, businesses can operate on credit, account for future receivables and payables, and charge depreciation if the machine would be used for a long time. In such a case, the professional must keep books of accounts that an Accounts Officer can use to calculate taxable income. Maintenance of Business Records – Maintaining business records is crucial to a company’s success.

Definition, Features and Examples

You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing. This rule is applicable for real accounts where tangible assets like machinery, buildings, land, furniture, etc., are taken into account. They have a debiting balance by default and debit everything that comes in, adding them to the existing account balance. Now that you have a clear idea of the types of accounts, let’s take a look at how they relate to the golden rules of accounting. A nominal account is a general ledger containing the transactions of a business, namely – expenses, incomes, profits and losses.

As per the rule, when the business incurs a loss or has an expense then you need to debit the account. If the business has a gain or earns an income then the account should have a credit. The assets and liabilities plus equity in the balance sheet of the double-entry bookkeeping system should be equal.

However, some businesses that have strictly money transactions could use the one-entry accounting methodology of bookkeeping as a substitute. Transactions related to income, expense, profit and loss are recorded under this category. These components actually do not exist in any physical form but they actually exist. For example, during the purchase and sale of goods, only two components directly get affected i.e money and stock.

A transaction is a two-way process in which value is transferred from one party to another. In it either a party receives a value in terms of goods etc. and passes the value in terms of money or vice versa. Check to see what type of account is being used in the transaction. Comparison of financial results – Accounting according to the golden principles makes it simple to compare financial outcomes from one year to the next.