There are two crucial methods loan providers used to choose if or not or not a homeowner is qualify for property equity loan, second mortgage or credit line. Earliest, it look at the homeowner’s current economic image.

Lenders can very quickly and effectively take a look at a homeowner’s creditworthiness. not, you may still find of a lot opportunities to raise up on push-by property appraisals, used to own non-GSE finance around $eight hundred,000, such domestic collateral finance, credit lines and you can refinances.

The most notable drawback off push-from the valuations is they tends to make assumptions about the interior of property, which can trigger improved exposure or less opportunity for each other loan providers and you will people. For-instance, a drive-because of the assessment otherwise assessment can get overvalue property the spot where the indoor keeps signs of deterioration beyond what would be anticipated into the home’s years. In addition, a house that was cautiously maintained and you may current because of the the residents will be underrated. Anyway, an exterior-only property updates statement will not always give enough perception and can trigger a terrible consumer sense

This new valuation technology

Technologies are with an adaptive effect on valuations guiding options that don’t need an appraiser or investigation collector to go into the inside of a property if you don’t look at the property whatsoever. Such the newest innovation might help expedite the fresh new valuation procedure, beat origination will cost you, relieve risks and improve valuation reliability.

Solutions are in fact readily available that will assess property on level playing with consistent assessment data (UAD) conditions. These tools can very quickly and rationally choose the overall position and you loan places Bristol can quality of property that aren’t usually recognized from inside the push-of the valuations.

Wise computers attention technical or smart image detection are widely used to generate these kind of valuation alternatives. That have desktop attention, the clear answer is taught to pull pointers away from visual supply, immediately after which get methods in line with the suggestions. This particular technology is already used on the whole valuation processes, also getting study range, report-building and quality assurance.

In the analysis range process, computers sight prospective proactively and you may instantly term and you may validate images and you may extract property keeps out of the individuals images. Technology can also select wreck otherwise fixes to ensure they certainly were handled inside the an assessment or valuation statement.

To possess appraisal or valuation statement production, computers sight is pick an interest property’s build concept, position and you may quality to accelerate new comparables-alternatives processes. Rather than being forced to search through pictures out of a share of equivalent transformation, pc attention immediately means possess which is often arranged and you may filtered to rather speed up the procedure, while maintaining objectivity and you can trustworthiness about analysis.

Along with brand new QA techniques, desktop attention twice inspections brand new property’s top quality and you can reputation, validates all of the right pictures had been removed, assists on reconciliation from associated enjoys and much more

Examine ?

Validate, another provider provided by Ice Home loan Technical, utilizes computer eyes technology, together with other brilliant analysis and you will statistics enjoys, to assist carry out clear, reputable, mission and you can credible valuations for most credit explore circumstances, plus household guarantee loans, lines of credit and you can refinances.

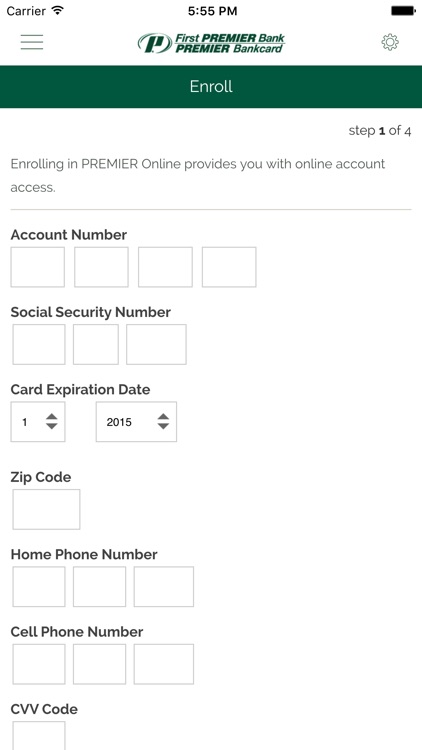

The brand new debtor have access to Examine as a consequence of a contact or text message hook up sent because of the bank or in direct the loan software. Pursuing the a series of effortless encourages, the fresh new debtor requires particular photos of its domestic for the a safe and controlled processes, in which precisely the digital camera on the product can collect the info. The brand new amassed info is tracked and recorded utilizing the place attributes toward borrower’s mobile device. It whole process takes a shorter time accomplish as compared to debtor locating and you will publishing the economic data files for their loan application.

Just after evaluating the new property’s standing and top quality, Confirm compares they with the exact same property to manufacture an ailment-adjusted really worth estimate. Domestic security try calculated of the deducting one a good home loan liens, since the known for the ICE’s public information study. In addition to distribution actual-day property photos, the newest homeowner completes a primary questionnaire one to confirms personal checklist data.

The citizen is additionally capable review of one assets-value-increasing features and you can expected repairs. Lenders discovered show compliment of a built-in API or a compact PDF statement. The lending company can choose to utilize Validate’s automatic valuation model (AVM) just like the a separate valuation otherwise ticket the data collection on their old-fashioned valuation-attributes merchant for additional studies.

Deleting subjectivity

Ten some other appraisers you certainly will render property ten different valuations. Of the leverage tech for the task, we’re improving studies structure while helping provide a legitimate, objective and you will credible worth of. And you will what already requires weeks or longer playing with old-fashioned steps, Confirm normally submit just moments.

John Holbrook, Vice president, Digital Valuation Solutions during the Freeze Fixed income & Study Features keeps over 28 numerous years of expertise in collateral exposure and you can valuation, that have held some roles because a keen appraiser, USPAP teacher and you will proper jobs at the LPS, Fannie mae, Guarantee Analytics and Black colored Knight.